Crowdfunding

An entrepreneur, a startup, and a small businessman they all can have practical money-making and job-creating ideas to create new businesses and help make a better community but they need money or a loan to fund and build their ideas.

Now to do so the first question comes in mind is “How can they raise the money to create this business? Next, is What is the roadmap? General when such people look for funds then The most common method is to get a loan from a bank. But banks consider startup entrepreneurial ventures too risky.

Especially when the economy sees a downturn and today’s restrictive lending policies then what we left as an answer is usually a big NO, which then indicates a clear way of very little new business development innovation or growth.

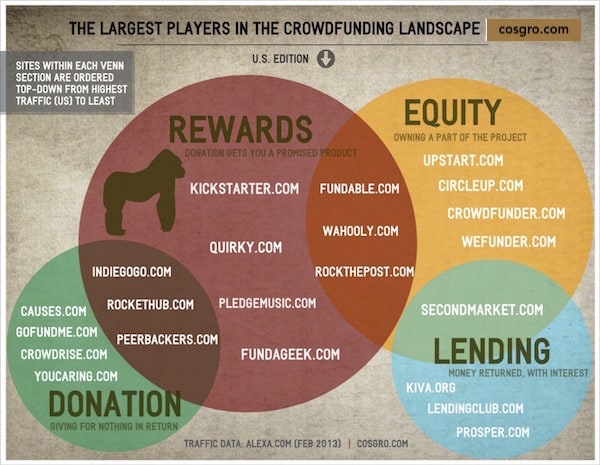

Currently an entrepreneur needs a business plan and a loan application then a drive to the bank to meet with the loan officers in the hope of getting a loan. But not anymore, the new era of funding can help these entrepreneurs, through the internet using cloud and social media environments, the entrepreneur can access hundreds or thousands of potential investors through CROWDFUNDING websites. There are several ways to seek crowdfunding

courtesy :- static1.squarespace

- The first is the donation method of crowdfunding this model has been around for years and people can donate money in small increments to a project which they believe has moral and ethical value and that is good for the community examples of these are asking for donations on Facebook causes or GoFundMe

- The second is the pre-order method of crowdfunding here people make online pledges during a campaign to pre-buy the product for later delivery, a good example of this is Kickstarter

- The third is the reward-based method of crowdfunding this is a variation on the two previous types where investors get the satisfaction of helping and immediately get a predetermined reward or item of value but no equity or ownership a good example of this is IndieGoGo and finally

- The fourth is equity-based crowdfunding this is the newest model that will allow large numbers of regular people like you and me to invest small amounts each online to fund early startups with the expectation to receive dividends or investment appreciation based on profits of the business.

credit :- dma.ucla

credit :- dma.ucla

So now we can see that crowdfunding is using the crowd to raise capital by connecting people with talent ideas and some neat stuff to sell. With those that have the funds to invest their way, thus creating jobs, new business opportunities, and fueling the economy.

Crowdfunding revenue is projected to top 2.8 billion dollars in 2012 and more than sixteen point ten billion dollars in 2016-2017. The speed of growth of crowdfunding from 2009 to 2016 is very similar to the growth pattern of the Internet in the early 1990s.

This raises the big question, Do you want to just watch crowdfunding happen and grow ? or Do you want to be a part of it?

How about leveraging the 3.58 billion Internet users worldwide who can be potential investors with a projected 300 billion dollars of investment revenue opportunity? Do you know the size and potential of your social capital? If, yes then discover how to capitalize on your network and learn to start your successful crowdfunding campaign now. And if no and you have any questions regarding the same, please comment on the section below and I will revert on the same.

Director Digital & Social Media Marketing | Affiliate Marketing | Media Buying | Trainer / Visiting Faculty Digital Marketing. Having 14+ Years of Experience in Digital Marketing. It was my hard work and effort that I was bestowed with “India’s Top 100 Digital Marketing Leadership Award” and “Indian Achiever’s Award” 2022

1 thought on “Need fund for Business ? Get an idea what is crowdfunding.”